IRS Announced HSA Contribution Limits 2023: Health Savings Account Details

The IRS has officially announced the 2023 contribution limits for Health Savings Accounts (HSAs). These tax-advantaged accounts offer individuals with high-deductible health plans (HDHPs) a valuable opportunity to save for future medical expenses while enjoying significant tax benefits. Contributing to an HSA can reduce your taxable income and accumulate funds for qualified healthcare costs.

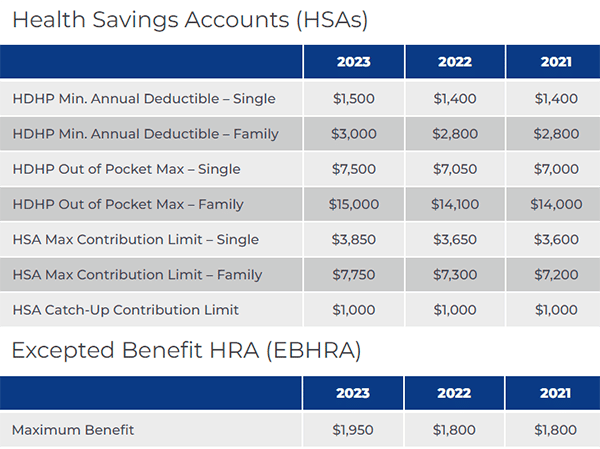

HSA Annual Contribution Limits for 2023

On April 29, 2022, the IRS announced the 2023 Health Savings Account contribution limits and the 2023 Excepted Benefit HRA benefit maximum within their release of Revenue Procedure 2022-24. The contribution limit for HSAs varies based on coverage type and age, with higher limits for individuals aged 55 and older. Employer contributions to HSAs are not taxable income for employees. Additionally, there are different contribution limits for family and self-only coverage, with family coverage generally allowing for higher contributions.

For updated contribution amounts, visit our benefit plan limits page on our website.

Changes are as follows:

It’s Your Money. Why Not Keep More of it?

Think of a health savings account (HSA) like a 401(k) for health care costs. HSAs are tax-advantaged accounts that accumulate interest and can earn investment returns. They are particularly beneficial for individuals with high-deductible health plans (HDHPs), as these plans qualify for HSA contributions. The funds can be used to pay for qualified medical expenses today or saved for future costs, offering significant tax savings during contributions and withdrawals.

Now is the time to share this information with your employees; if you do not have an HSA account yet, we can help!

Managing people, staying compliant, or keeping up with benefits administration can be overwhelming. HRPro helps you with day-to-day HR tasks so you can focus on running your business.

HRPro Accounts

248-265-3984 option 4

accounts@hrpro.com