HSA/HDHP Limits Will Increase for 2026

On May 1, 2025, the IRS released Revenue Procedure 2025-19 to provide the inflation-adjusted limits for health savings accounts (HSAs) and high deductible health plans (HDHPs) for 2026. The IRS is required to publish these limits by June 1 of each year.

These limits include the following

- The maximum HSA contribution limit;

- The minimum deductible amount for HDHPs; and

- The maximum out-of-pocket expense limit for HDHPs.

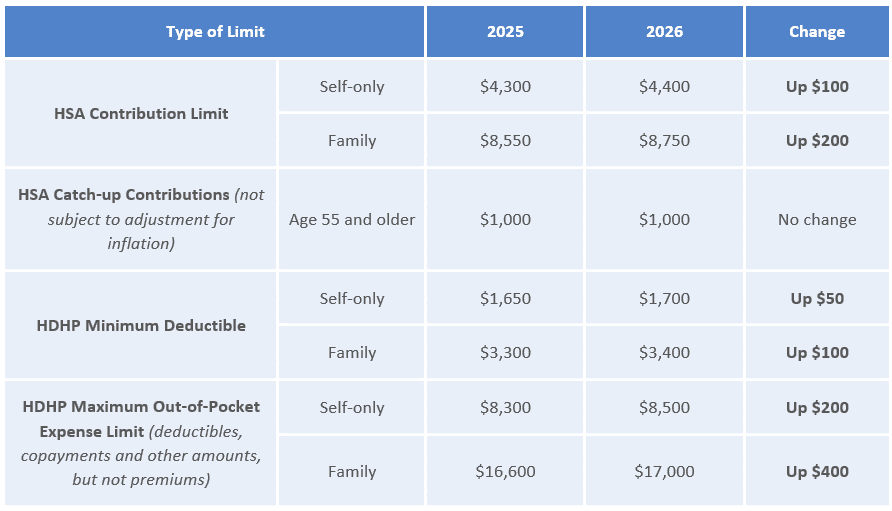

These limits vary based on whether an individual has self-only or family coverage under an HDHP. Eligible individuals with self-only HDHP coverage will be able to contribute $4,400 to their HSAs for 2026, up from $4,300 for 2025. Eligible individuals with family HDHP coverage will be able to contribute $8,750 to their HSAs for 2026, up from $8,550 for 2025. Individuals age 55 and older may make an additional $1,000 “catch-up” contribution to their HSAs.

The minimum deductible amount for HDHPs increases to $1,700 for self-only coverage and $3,400 for family coverage for 2026 (up from $1,650 for self-only coverage and $3,300 for family coverage for 2025). The HDHP maximum out-of-pocket expense limit increases to $8,500 for self-only coverage and $17,000 for family coverage for 2026 (up from $8,300 for self-only coverage and $16,600 for family coverage for 2025).

HSA/HDHP Limits

The following chart shows the HSA and HDHP limits for 2026 compared to 2025. It also includes the catch-up contribution limit that applies to HSA-eligible individuals age 55 and older, which is not adjusted for inflation and stays the same from year to year.

Important Dates

- Jan. 1, 2026 – The new contribution limits for HSAs become effective.

- 2026 Plan Years – The HDHP cost-sharing limits for 2026 apply for plan years beginning on or after Jan. 1, 2026.